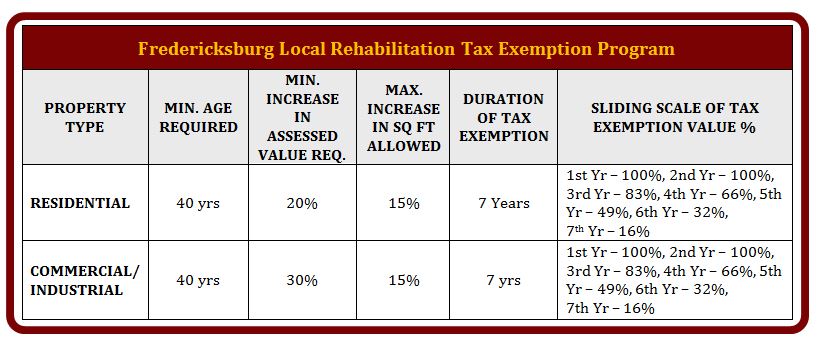

For additional information, please contact the Commissioner of the Revenue by mail (City Hall, 715 Princess Anne Street; Fredericksburg, Virginia 22401) or by phone (540-372-1207).

A partial exemption from real estate taxes for qualifying rehabilitated real estate administered on a sliding scale over a seven (7) year period [See Sections 70-98.1 and 70-99.1 of the City Code for specific details and provisions.]. For qualified projects, the initial increase in the amount of real estate taxes owed resulting from the property’s rehabilitation is excused for two (2) years and continues on a declining or sliding scale for five (5) additional years.

NOTE: If the property is sold, the exemption remains in effect for the new owner until the expiration date.